1. Financialization and the rise of systemic risks

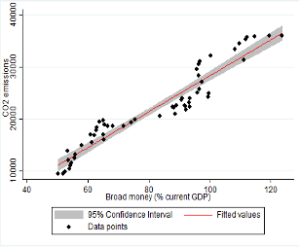

It is now established that the increasing financialization of the global economy is facilitating the acceleration of our planet’s destabilization. As shown in Figure 1, a simple linear regression between global financial development (measured by the M2/GDP ratio) and kilotons of CO2 emissions displays a correlation coefficient of 0.953. Similarly, a linear regression between global stock market capitalization and CO2 emissions displays a correlation coefficient of 0.9605. These results should be interpreted in the broader context of the joint evolution of socioeconomic and bio-geophysical indicators and the disruption of the Earth System caused by the Great Industrial Acceleration (Steffen et.al, 2015).

Figure 1. atmospheric CO2 emissions and global financial development, 1960-2019 (p-value 0.000)

Data: World Bank, calculation by Lagoarde-Segot & Martinez (2021)

Despite the climate emergency, the monetary and prudential policies followed by most Central Banks in recent years have contributed to increasing, rather than reversing, this systemic disruption dynamic. Since the 2008 financial crisis, central banks have issued reserve money (also called M0 or « monetary base ») to finance governments, companies and banks in the Eurozone, where monetary financing of States is prohibited by the ECB’s mandate.

The ECB has thus allowed « zombie » companies and banks to survive; massively buying up private debts, and in the process saving investors by pooling their losses.

Supporting the real economy – through credit to businesses – has been the main justification for these « quantitative easing » policies. However, the money used in economic transactions nowadays mainly takes the form of bank deposits; and as the Bank of England (2014) and the majority of money specialists point out, these bank deposits, convertible on demand into cash, are overwhelmingly created through the bank credit channel. Banks do not need initial reserves to lend to the public, since the monetary system allows them continuous access to reserve money (via the interbank market or the Central Bank’s lending facility).

Under these conditions, it is not surprising to note, as Figure 1 shows, that the trillions of reserve money injected into the financial system have fueled the development of speculative bubbles, both in equities and in real estate. And even if there were a demand for financing viable projects that would allow for a compatible transition in accordance with the Paris Climate Agreement, there is nothing today to compel banks to fund those.

Figure 1 Monetary basis

This monetary and financial dynamic is accompanied by a sharp increase in income inequalities (e.g. poor housing for some, real estate gains for others), which has as its backdrop a rise in private debt and massive deindustrialization in many European countries.

In this context of rising risks that could, in the worst case scenario, lead to the collapse of some European countries7, we call for a series of strong measures adapted to the urgency of the situation. It is a question of rapidly planning the financing of energy, health and agricultural transitions, as well as access to care and medicine, in order to rapidly reach a minimum local production for the survival of populations in these areas, and to allow the resilience of society in the face of shocks.

The technical solutions most often put forward to finance this « war effort » are known. It would be necessary either to redirect savings, to direct a special « transition » money creation, to increase taxes for grey sectors, or to increase the state deficit. The ideal solution would of course be a combination of all four.

In this note, however, we present a fifth avenue, discussed in detail by Lagoarde-Segot (2020). This consists of an ambitious overhaul of credit policy at the European level, based on the reintroduction of measures that have already worked in the past in a similar context, or are currently in place in other countries.

Before detailing the proposed mechanisms, however, it should be emphasized that the success of any policy of ecological reconstruction is conditional on the establishment of a robust taxonomy between the « brown » sector and the « SDG-compatible » sector. In this respect, the EU taxonomy for sustainable activities, a standard developed in the framework of the European Green Deal in relation to the commitments of the 2030 Agenda, is still largely insufficient, for four main reasons. Firstly, it does not define the world and the forms of production, particularly agricultural, towards which we should aim outside of energy, transport and construction. Second, and contrary to the commitments of the 2030 Agenda, it does not take into account the social costs of the green transition, and does not give any specific interest to the most marginalized territories and populations. Thirdly, it leaves SMEs outside the scope of analysis despite their crucial role in the functioning of the European economy. Finally, it is based on concepts and legal standards that are disconnected from any scientific data.

2. New credit management indicators

Assuming that a robust taxonomy has been established, Table 1 presents two simple indicators that the European Central Bank could use to redirect credit in the euro area.

Table 1. Credit Framework Indicators Central Bank

The first indicator measures the flow of credit to the SDG-compatible sector as a proportion of total credit. It is therefore a ratio of « green » money to « brown » money created by commercial banksannually. We propose that the value of this indicator be quickly set at 4. Thus, for a given year, banks should issue four times more credit to finance ecological and social reconstruction than to finance the actors of the « brown » sector. The second indicator measures the share of « SDG-compatible » assets (including loans issued to finance reconstruction) in banks’ balance sheets. We propose to set the value of this ratio at 4. In order to reach this target value, banks will be forced to sharply reduce financing costs for the SDG-compatible sector and increase financing costs for brown sector assets.

This ambitious European credit policy would enable the production structures of the economy to be aligned with the objectives of sustainability and thus to set in motion a genuine ecological and social reconstruction of the continent. It would make it possible to finance the development of new companies for the development of renewable energies, with the creation, for example, of a European solar collector production sector. It would ensure the development of freight, suburban agro-ecology and short circuits of production in the urban belt. It would offer massive support to the network of small and medium- sized enterprises (SMEs) that make up the territory.

This policy would put a stop to the most harmful activities. It would also encourage firms to convert their production lines in order to create new « champions » of ecological reconstruction. Companies such as Renault or Airbus could thus easily convert their production lines in part to transition projects. In what follows, we present three levers that would allow these European credit policy objectives to be achieved quickly.

Lever 1: A greening of the marginal lending facility

To achieve these objectives, the Central Bank will need to rapidly change the conditions for bank access to reserve money by linking them to the holding of SDG-compatible assets.

Today, banks in the euro zone must hold reserve deposits with the European Central Bank up to 1% of the value of their deposits. In return, the ECB, in turn, must provide reserves on demand up to the value of the securities that provide a guarantee on the credit provided by the central bank to the private bank. This loan, backed by collateral, is the central bank’s asset, as shown in Table 2.

Table 2. Guaranteed loans in the Euro-system.

It should be remembered that the reserves held by banks do not in any way limit lending in the real economy, as banks have continuous access to reserves via the interbank market and the ECB’s marginal lending facility. However, the European Central Bank applies a « haircut » to the value of the collateral provided.

The ECB currently determines the haircut category of an asset by combining criteria related primarily to the type of asset and the group to which its issuer belongs.

Its supervisors regularly review these haircut categories solely from the perspective of the financial risk involved and taking into account macroeconomic developments. For example, as part of its 2020 pandemic emergency repurchase program, the European Central Bank changed the scope of Additional Credit Claims (ACC) to include claims related to corporate sector financing. Unfortunately, this policy does not include any criteria related to ecological and social reconstruction imperatives, which amounts to massive ECB support for the brown sector (Reclaim Finance, 2020).

In order to allow for the rapid financing of ecological reconstruction, we recommend a massive increase in the haircut applied to brown assets and their issuers (the « brown » banks that do not meet the prudential ratios presented in Table 1). This haircut could be set at 90% for banks that lend excessively to the brown sector, or hold excess brown assets on their balance sheet, relative to the target.

This proposal is justified by many historical examples of successful central bank modifications of collateral frameworks to achieve certain socio-economic objectives8.

Lever 2: rediscounting bank loans to the SDG-compatible sector

To complement this arrangement, the ECB could rediscount loans to the SDG sector. This would allow banks to obtain reserve currency loans and advances directly from the Central Bank, using their loans as collateral. Recall that rediscounting of bank claims has fallen into disuse in most OECD countries, but was common until the 1990s, particularly in developing countries. In a 1985 report on small business lending, the World Bank stated, for example, that « the most successful arrangement for encouraging commercial banks to become intermediaries is to have an agency to rediscount loans made by lending institutions » (Levitski, 1985, p. 22).

The rediscounting of bank claims was also used successfully in France, where, in the aftermath of the Second World War, it was used as a means of reducing the amount of money owed to banks.

Similarly, during World War II, the U.S. government established a guaranteed loan program to accelerate industrial conversion. More than half of the loans, those under $100,000, were directly rediscounted at 100% locally by the Federal Reserve.

Finally, many central banks in developing countries (e.g., the Philippines, Nigeria, or India) are currently using rediscounting policies to provide sufficient financing to priority sectors.

The European Green Deal platform has championed this approach by calling for the European Investment Bank to issue long-term green bonds, which would then be bought back by the European Central Bank as part of its asset purchase program (Green Deal, 2019).

The rediscounting of SDG credits would provide a positive incentive to banking system actors.

Lever 3: creation of an interbank market for SDG sector loan certificates

It is very likely that some banks will not be able, for technical reasons, or will not want to reach the annual target set under this scheme. Other committed banks (such as the Dutch bank Triodos, or in France the Crédit Coopératif Group) will be far beyond the target. In other words, some banks may have while other banks may have exceeded it. The creation of a market for SDG loan certificates, in the spirit of the Indian Priority Sector Lending Certificates (PSLC), seems to us to be particularly appropriate for managing these imbalances and providing the necessary flexibility to the system.

In India, the Central Bank sets lending targets for priority sectors (such as agriculture, education, or small and medium enterprises). Banks can sell and buy priority sector loan certificates (PSLCs) through a trading platform managed by the Central Bank. Surplus banks sell the execution of the priority sector bond to the purchasing banks. The transaction does not involve any transfer of the loan or associated risks between contracting banks.

We propose that in Europe a similar system be set up with a commission (the price of these certificates) that would be determined by comparing supply and demand with a floor price set by the ECB. Consideration should be given to the steering of the system by the ECB, which could, under certain conditions, become the buyer of last resort. By allowing surplus banks to sell their excess ODD- compatible loans, this mechanism could give the banking sector the flexibility to make the transition, while creating a significant additional source of income (and thus market advantage) for banks that exceed the target.

Should these policies prove insufficient, the central bank would have to step in and finance the transition at any cost. The ECB could then lend member states 2,000 billion in « transitional debt”. Repayments would only start when minimum thresholds for certain social and environmental indicators are reached. The states would be obliged to use this money to finance new ad-hoc companies, along the lines of Airbus, created to ensure the transitions in the three sectors of energy, health and agriculture. These companies would eventually be privatized when the transition objectives are reached.

3. Conclusion

To conclude, we are currently leading a « fake war » on climate change, however the urgency of financing transitions and the risks of various collapses must lead us to renew the relationship between the ECB and private banks. We have proposed a few policy suggestions in this policy brief based on historical and international best practices. Of course, this policy, while necessary, may not be sufficient to “win the war”. Indeed, the supply of credit does not create the demand for credit. SDG sector loans must also be profitable, and even simply requested. Additional policies, such as a carbon price and accompanying investments by the State are clearly needed on top of those outlined in this note.

Références :

Feiertag, O. Le Nerf de L’après-Guerre: le Financement de la Reconstruction Entre l’Etat et le Marché (1944–1947). Matériaux Pour L’histoire Notre Temps 1995, 39, 46–51.

Green New Deal for Europe. Blueprint for Europe’s Just Transition. 2019. Rapport disponible à l’adresse: https: //www.gndforeurope.com/10-pillars-of-the-green-new-deal-for-europe

Lagoarde-Segot, T., 2020. « Financing the Sustainable Development Goals ». Sustainability 2020, 12, 2275.

Leclercq, Y. Les transferts financiers. Etat-compagnies privées de chemin de fer d’intérêt général (1833–1908). Rev. Econ. 1982, 33, 896–924.

Levitski, J. World Bank Lending to Small Enterprises. A Review; Industry and Finance Series Volume 16; The World Bank: Washington, DC, USA, 1985.

Reclaim Finance, 2020.Quantitative easing and climate : the ECB’s dirty secret. Rapport disponible à l’adresse https://reclaimfinance.org/site/wp-content/uploads/2020/05/Report-Quantitative-easing-the-ECBs-dirty-secret-RF.pdf

Steffen, W., Broadgate, W., Deutsch, L., Gaffney, O., & Ludwig, C. (2015). The trajectory of the Anthropocene: The Great Acceleration. The Anthropocene Review, 2(1), 81–98. https://doi.org/10.1177/2053019614564785